Onboarding Stripe Connect

This section describes how to onboard Stripe as your payment gateway. PrintSharing uses Stripe Connect to process guest payments. This setup allows guest payments to flow directly to your Stripe account, giving you full control over your revenue while automatically handling the MyQ platform fee. As the merchant of record, you'll manage customer receipts, refunds, and payment disputes directly through your Stripe account.

Stripe onboarding is necessary if you will use Paid Printing mode. You do not need Stripe Connect to use Complimentary Printing mode.

Before You Begin

First, verify that your country is supported by Stripe. Then, to complete the onboarding, you will need:

Business information (legal name, address, tax ID)

Banking details for receiving payouts

Contact information for your business

Approximately 15-30 minutes to complete the process

During setup, Stripe will guide you through creating a Stripe Standard Connected Account. If you have an existing Stripe account, you will be prompted to log in.

Each Stripe account includes a sandbox environment that you can use to validate your integration before you start working with real transactions.

For more information, see the Stripe documentation:

Complete Stripe Connect Onboarding

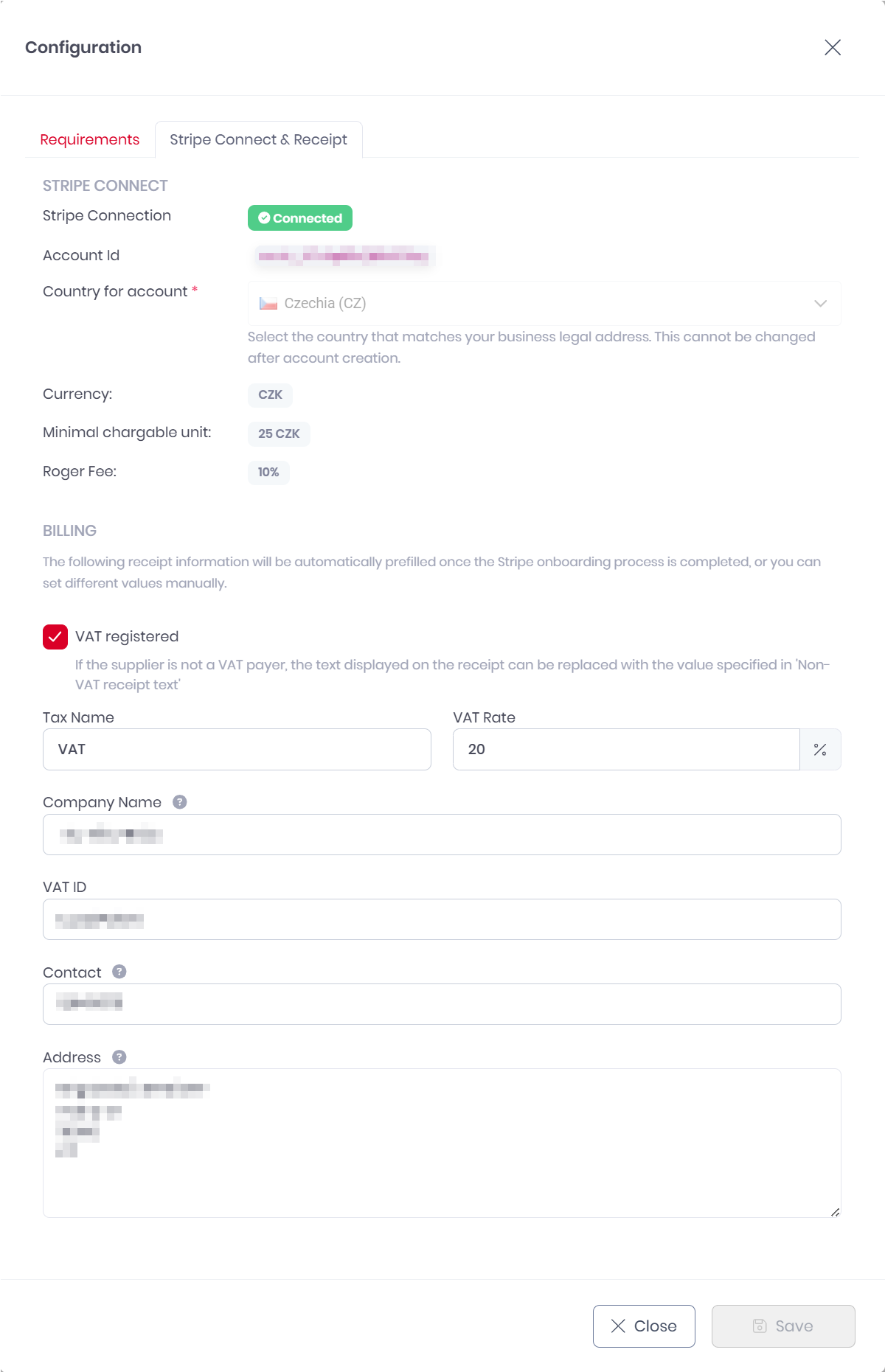

Go to Roger > PrintSharing > Configuration, and select the Stripe Connect & Receipt tab.

Click Open Stripe Onboarding. You are redirected to Stripe's secure onboarding platform where you create your account.

Proceed through the form, and provide your business information. This varies depending on your location, but typically includes details such as:

Business details: Legal business name, type (individual, company, non-profit), and industry

Contact information: Phone number and email address for account notifications

Business address: Physical location where your business operates

Tax information: Tax ID

Banking information: IBAN for the account where you want to receive payouts from guest payments

Account Verification Process

When you finish filling out all required fields in Stripe's onboarding form and submit, you'll be redirected back to Roger. You'll see a success message: "Stripe Connect onboarding completed."

Important: This does NOT mean your account is immediately active.

After you complete the form:

Stripe reviews your information: Stripe verifies your business details, which may take several hours to several days.

Roger checks account status: Roger server continuously queries Stripe to check if your account is fully verified and active.

Automatic activation: Once Stripe approves your account, Roger automatically switches payments to flow directly to your Stripe account.

During the verification period (PENDING state):

Your PrintSharing service remains operational

You can still test and use PrintSharing normally

Once verification completes (CONNECTED state):

Payments automatically flow directly to your Stripe account

You see the full revenue (minus MyQ platform fee and Stripe processing fees)

You manage payouts, refunds, and disputes through your own Stripe dashboard

Review Billing Details

After completing Stripe Connect onboarding, review your billing details. These appear on all guest receipts.

Roger automatically imports business information from your Stripe account, but you can edit any field to customize how your business appears to guests. For example, use a customer-facing name ("Downtown Hotel") instead of your legal entity name, or specify a location-specific address.

To review and edit billing details:

Go to Roger > PrintSharing > Configuration.

Select the Stripe Connect & Receipt tab.

Under BILLING, review and update the following fields:

VAT registered

Select if your organization is a registered VAT payer.Tax Name

Type a label for your tax. For example, “Sales Tax” or “VAT”.%TaxName% Rate

Enter your applicable tax rate as a percentage.Company Name

Your business name as it should appear on receipts.VAT ID (EU businesses only)

Enter your VAT identification number for tax reporting.Contact

Provide an email, phone number, or website for customer inquiries.Address

Your business address (imported from Stripe, editable).

Click Save

Review Minimum Chargeable Amount

When processing payments, each currency has a minimum amount that can be charged to customers. These thresholds exist because transaction processing costs make very small payments impractical, and some currencies have denominations that do not support fractional amounts.

The table below shows the most common 21 currencies. For a list of the minimum chargeable amounts for all supported currencies, see Minimum Chargeable Amounts.

Currency Code | Currency Name | Minimum Chargeable Amount |

|---|---|---|

AUD | Australian Dollar | 2 AUD |

BRL | Brazilian Real | 6 BRL |

CAD | Canadian Dollar | 2 CAD |

CHF | Swiss Franc | 1 CHF |

CNY | Chinese Yuan | 10 CNY |

CZK | Czech Koruna | 25 CZK |

DKK | Danish Krone | 8 DKK |

EUR | Euro | 1 EUR |

GBP | British Pound Sterling | 1 GBP |

HKD | Hong Kong Dollar | 8 HKD |

INR | Indian Rupee | 100 INR |

JPY | Japanese Yen | 150 JPY |

KRW | South Korean Won | 1500 KRW |

MXN | Mexican Peso | 20 MXN |

NOK | Norwegian Krone | 10 NOK |

NZD | New Zealand Dollar | 2 NZD |

SEK | Swedish Krona | 11 SEK |

SGD | Singapore Dollar | 2 SGD |

TWD | New Taiwan Dollar | 40 TWD |

USD | United States Dollar | 1 USD |

ZAR | South African Rand | 20 ZAR |